Vehicle

New, Pre-owned, Refinance, Lease Buyout

Let the Unilever Federal Credit Union experts help you through the entire process of purchasing a vehicle. A pre-approved UFCU loan will put you in a better bargaining position with dealers.

Our vehicle loan rates are guaranteed to make you smile and save!

Key Features and Benefits

- Excellent rates

- A 0.25% or .50% rate discount when you open a 1-year Share Certificate with us

- Flexible repayment terms up to 72 months (new) and 60 months (pre-owned)

- No application fee

- No prepayment penalties

- 100% financing-no down payment required

- We lend across the country

Refinance Your Current Auto Loan

Refinancing your loan from another lender could save you hundreds of dollars in interest and lower your monthly payments, simply submit the vehicle loan application to start the process.

Get Pre-Approved

Attaining pre-approval ahead of time may give you additional negotiating power to purchase your vehicle at the best price. And knowing how much you can spend will keep you within your budget.

Estimate Your Monthly Payment

Calculate your monthly payment or loan amount with our loan calculator.

Have Questions? Contact Us

John Holtzhauer (203) 816-4066

Angelica Calderon (203) 816-4069

or email credit.union@unilever.com for assistance.

Your personal information is safe and secure with Unilever Federal Credit Union.

Boat and RV Loans

Escape to the great outdoors. Recreational vehicles and boats are great ways to relax, go exploring or enjoy quality time with your family. Let us help you add fun to your life and finance a new or used boat or RV.

| NEW Boat/RV |

Term | Fixed Rate APR* |

| Boat/RV | 60 months | 5.25% |

| Boat/RV | 72 months | 5.75% |

| Boat/RV | 84 months | 5.875% |

| Boat/RV | 96 months | 6.125% |

| Boat/RV | 120 months | 6.50% |

| Boat/RV | 132 months | 6.625% |

| Boat/RV | 144 months | 6.75% |

| Boat/RV | 156 months | 6.875% |

| Boat/RV | 168 months | 7.00% |

| Boat/RV | 180 months | 7.25% |

| Used Boat/RV |

Term | Fixed Rate APR* |

| Boat/RV | 60 months | 5.50% |

| Boat/RV | 72 months | 5.875% |

| Boat/RV | 84 months | 6.00% |

| Boat/RV | 96 months | 6.25% |

| Boat/RV | 108 months | 6.625% |

| Boat/RV | 120 months | 6.75% |

| Boat/RV | 132 months | 7.00% |

| Boat/RV | 144 months | 7.25% |

| Jet Skis New / Used |

Term | Fixed Rate APR* |

|

Jet Skis |

36 months | 10.75% |

Features

- Repayment terms available up to 180 months

- New, Used or Refinance

- Maximum amount financed $250,000.00

- No prepayment penalty

- No application fees

- Fast pre-approvals

- Credit Life and Disability Insurance available for eligible borrowers

Requirements

- Full coverage physical damage insurance

- Minimum Required FICO Score of 760

- Minimum Down Payment of 15%

- Membership with the Credit Union

Refinance

Already have a loan? Get a free refinance quote and find out how much you could save on monthly payments.

Hit the outdoors with Unilever Federal Credit Union

Please note: After completing the application, a pop up screen will appear to add a co-applicant.

If you do not have a co-applicant simply click on NEXT.

We finance it all

UFCU makes it easy to purchase or refinance a variety of new or used recreational vehicles including:

-

- Travel Trailers

- Motor Homes

- Pontoon Boats

- Jet Skis – Wave Runners

- Bass Boats

- Sail Boats

- Center Console

- Cabin Cruiser

Estimate Your Monthly PaymentCalculate your monthly payment or loan amount with our loan calculator.

Refinances Welcome!

Refinancing your loan from another lender could save you hundreds of dollars in interest and lower your monthly payments. Contact us to compare financing.Have Questions? Contact Us

John Holtzhauer (203) 816-4066

Angelica Calderon (203) 816-4069

or email credit.union@unilever.com for assistance.Your personal information is safe and secure with Unilever Federal Credit Union.

*Annual percentage rate. Actual APR based on credit worthiness. Rate is subject to change at any time without notice.

Repayment terms available up to 180 months. Minimum required FICO Score of 760.

Minimum down payment of 15%. Maximum amount financed $250,000.00

Existing UFCU loans cannot be refinanced; applies to new loans only. Membership required.

Personal

Personal Loans

Fixed-term or revolving credit personal loans allow you to borrow funds that are secured by your signature, good credit history, and promise to repay.

- You determine the purpose and create your own loan

- Amounts up to $20,000 are available for qualified borrowers

- Personal loans under $5,000 require a minimum 720 FICO credit score

- Personal loans over $5,000 require a minimum 760 FICO credit score

- Click here to view our current rates

Your ability to repay and your credit worthiness are considered when determining the maximum loan amount you may be eligible for.

Overdraft Protection

Overdraft Protection is available to protect your UFCU checking account from becoming overdrawn, incurring fees and potentially a check being returned. It is available when you need it to cover a check, make a VISA Debit Card purchase, or withdraw funds at an ATM. No interest is charged until you overdraw your checking account balance.

Please note: After completing the application, a pop up screen will appear to add a co-applicant.

If you do not have a co-applicant simply click on NEXT.

Estimate Your Monthly Payment

Calculate your monthly payment or loan amount with our loan calculator.

Have Questions? Contact Us

John Holtzhauer (203) 816-4066

Angelica Calderon (203) 816-4069

or email credit.union@unilever.com for assistance.

Your personal information is safe and secure with Unilever Federal Credit Union.

Student Loan Program

Whether you’re an undergraduate, graduate student, or parent, UFCU Student Loan Program is designed for you. Enjoy lower rates and flexible repayment terms. Our Student Loan Program includes student refinance, continuing education and tuition reimbursement.

Student Refinance Loan

Unilever Federal Credit Union Student Loan Refinance Program specializes in helping Unilever professionals and their family members refinance their existing student loan debt and consolidate all loans federal and private into one single loan with one bill.

Benefits of refinancing your existing student loan debt:

| Loan Type | Term | Fixed Rate APR* |

| Refinance & Continuing Education |

96 | 5.99% |

| Refinance & Continuing Education |

84 | 5.75% |

| Refinance & Continuing Education |

72 | 5.50% |

| Refinance & Continuing Education |

60 | 5.375% |

| Refinance & Continuing Education |

48 | 5.25% |

| Refinance & Continuing Education |

36 | 5.125% |

| Refinance & Continuing Education |

24 | 4.875% |

- Excellent rates

- A 0.25% or .50% rate discount when you open

a 1-year Share Certificate with us - Switch to a lower interest fixed rate

- Shorten the loan term

- Save more overall on total interest

- No Prepayment Penalties

- Principal payments permitted

- Simplify your monthly bill through consolidation

- Maximum Loan Amount $50,000

Qualifications

You must be a U.S. citizen or permanent resident alien with a valid U.S. Social Security Number

Continuing Education Loans

For those attending or borrowing for a student attending a degree-granting institution. Whether you’re an undergraduate student, graduate student, or parent helping a student pay for school, this flexible loan is designed to meet your needs.

- Borrow up to $50,000

- No origination fees, no prepayment penalty

- The check would need to be payable to the University

Tuition Reimbursement Education Loans

We offer a tuition reimbursement loan, where no monthly payments are required for up to 5 months. Interest accrues. Once you complete the course and your employer reimburses you, you would simply pay off the loan and the interest that has accrued since the loan opening date.

- Borrow up to $50,000

- No origination fees, no prepayment penalty

- The check would need to be payable to the University

- Current fixed interest rate is 5.50% 5 Month Term

Please note: After completing the application, a pop up screen will appear to add a co-applicant.

If you do not have a co-applicant simply click on NEXT.

Try our student loan refinancing calculator to see how much you might be able to save by refinancing.

Have Questions? Contact us

John Holtzhauer (203) 816-4066

Angelica Calderon (203) 816-4069

or email credit.union@unilever.com for assistance.

*APR=Annual Percentage Rate. Rates are subject to change without further notice. The actual APR of the loan is based upon credit score and capability to repay loan. All loans are subject to Credit Union lending guidelines and credit worthiness.

The maximum amount to borrow is $50,000.

Loans under $10,000 require a 700 minimum FICO credit score.

Loans between $10,001 and $20,000 require a 740 minimum FICO credit score.

Loans between $20,001 and $50,000 require a 760 minimum FICO score.

You must be a member of UFCU to apply. You must provide tuition bill.

Refinance and Continuing Education Loans

Monthly payments begin 30 days after the loan proceeds have been disbursed, and proceeds are paid.

Continuing Education and Tuition Reimbursement

You would need to apply each time you plan on taking courses. We cannot advance funds that exceed your current tuition amount (we cannot advance funds for courses you plan to take in the future).

Your personal information is safe and secure with Unilever Federal Credit Union.

Home Purchase & Refinance

A home mortgage is one of the most important loans you will need. UFCU has a line of mortgage products available for purchasing a new home or vacation home, refinancing an existing mortgage, or taking advantage of the equity in your existing home. Our mortgages are available in the continental United States.

Our mortgage rates are being updated frequently! based on the market.

For additional information please contact john.holtzhauer@unilever.com; 973-945-1057.

- Competitive low rates

- No points. No prepayment penalties

- Affordable mortgage options

- Mortgage pre-qualification

- Expert help from a UFCU mortgage specialist

- Quick approvals and local closings make the entire process fast and hassle-free

Purchase-Money Mortgage Loans Available with

Down Payments As Low As 5%

- 5% Down Payment Program

- Maximum Loan Amount $766,550.00

- Owner occupied, single family homes. Includes townhomes and condominiums

- Minimum FICO Score for 5% Down Payment Program is 720

- Down Payments of less than 20% require private insurance

Refinances Welcome!

Refinancing your loan from another lender could save you thousands of dollars. Contact us to compare financing.

Get started on your mortgage application or pick up where you left off

Have the following information available when applying:

- The income for all borrowers – Your W2s and tax returns will provide the information you need

- Your current monthly expenses – Write down your monthly expenses like rent, mortgage, utilities, credit cards, average spending, etc.

- An estimate of the funds you have available for a down payment, closing costs, taxes, and other costs.

More Options

Print the PDF version and submit it by mail:

Unilever FCU, P.O. box 1112, Englewood Cliffs, NJ 07632

Useful Links

View our current rates

Mortgage Calculator

Mortgage Checklist

Thinking about buying your first home? Take some proactive steps

Our Vice President of Lending

John Hotlzhauer

NMLS# 202179

UFCU MLS# 457994

Cell: 973-945-1057

Work: 203-816-4066

Email: john.holtzhauer@unilever.com

Have additional questions?

Please reach out and contact us.

Your personal information is safe and secure with Unilever Federal Credit Union.

The Secure and Fair Enforcement for Mortgage Licensing (SAFE) Act is designed to enhance consumer protection and reduce fraud by requiring a nationwide registration system for mortgage loan originators (MLOs). Each MLO obtains a unique identifier from the Nationwide Mortgage Licensing System and Registry (NMLS). This information allows a consumer applying for a mortgage loan to verify the MLO is properly registered and to obtain basic information about the MLO’s mortgage lending history. Unilever Federal Credit Union: NMLS #457994.

Heloc

Home Equity Line of Credit

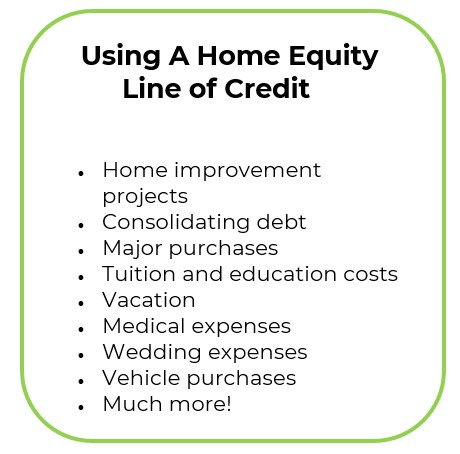

A home equity line of credit (HELOC) is a revolving credit line secured by the equity in your home. A HOME Equity Line of Credit is a great way to access funds for big-ticket expenses. From home remodeling, education expenses, vacation funding, to unexpected emergencies.

Benefits of a HELOC

- Benefit from rates as low as 7.00% APR*

- Up to 75% total loan to value

- HELOC limits up to $100.000.00

- 10-year draw period (funds are there when you need them)

- A revolving line of credit, open for 10 years with 15 years to repay the balance

- Pay interest only on the funds you use

- No application, no annual or inactivity fee

- No points or prepayment penalties

- Primary residence only

- Convenience checks or online access to funds

Ways to Access Your HELOC Loan

- Transfer the funds to your UFCU checking account or request convenience checks

- Bank-to-bank transfer (complete our ACH electronic form)

- Easy to pay online, set-up automatic payments

Requirements

- Minimum FICO credit score 750

- UFCU membership

What to expect when you apply

- Submit an online application (an email will follow soon after)

- If the HELOC is conditionally approved, we’ll ask the following:

. Homeowner’s insurance declaration page

. Current pay slip and most recent two years W-2s

. Most recent mortgage statement

Have Questions? Contact Us

John Holtzhauer

Vice President of Lending

NMLS# 202179

UFCU MLS# 457994

Cell: 973-945-1057

Work 203-816-4066

Email: john.holtzhauer@unilever.com

Rates and terms are subject to credit approval and may change without notice.

Consult your tax adviser for tax-deduction eligibility on Home Equity Loans.

Property Insurance is required. The Credit Union reserves the right to change any conditions of these programs, or to withdraw them, without prior notice. This Credit Union is federally insured by the National Credit Union Administration.

*The HELOC interest rate is an adjustable rate currently based on the Prime Rate, minus 1.00% (With a minimum interest rate of 5.00%). Rates are subject to change.

Your rate will be reviewed monthly. The maximum Annual Percentage Rate that can apply is 12.00%, or the maximum permitted by law, whichever is less. A minimum FICO credit score of 750 is required.

Maximum loan-to-value 75% (HELOC, and any senior mortgage, not to exceed 75% of home’s appraised value). The maximum home equity line of credit loan amount is $100,000.00.

HELOC repayment/draw terms:

You can obtain advances during the initial 120 month period (the draw period) of your HELOC. During your draw period, your minimum monthly payment will be the greater of $100.00, or the interest due for the month. The remaining 60 month period of your HELOC is the repayment period. Your minimum monthly payment during the repayment period will be 1/60th of your principal balance at the end of the draw period, plus the monthly interest due.

The Secure and Fair Enforcement for Mortgage Licensing (SAFE) Act is designed to enhance consumer protection and reduce fraud by requiring a nationwide registration system for mortgage loan originators (MLOs). Each MLO obtains a unique identifier from the Nationwide Mortgage Licensing System and Registry (NMLS). This information allows a consumer applying for a mortgage loan to verify the MLO is properly registered and to obtain basic information about the MLO’s mortgage lending history. Unilever Federal Credit Union: NMLS #457994