3.25% APR** INTRODUCTORY BALANCE TRANSFER FOR 12 MONTHS

While you may find offers for lower introductory rates, you are likely to find that the regular rate that goes into effect after that promotional period could be much higher. The higher the rate, the more interest you may pay if you don’t pay your balance in full each month

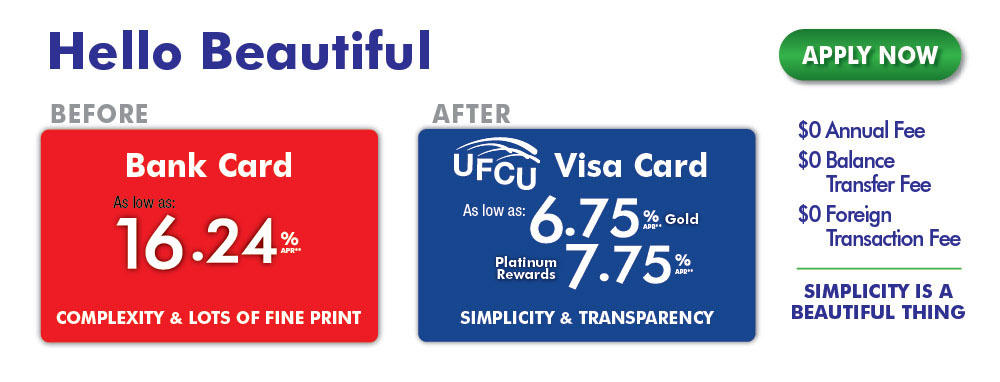

Our Visa Credit Cards have a low introductory rate and thereafter your regular rates start

as low as

6.75% APR* for Visa Gold and

7.75% APR* for our Visa Platinum Rewards

Both cards do not have an annual fee. In fact, it doesn’t have fees for balance transfers, cash advances, foreign transaction fees, plus you enjoy the same low rate for purchases or cash advances

Stop paying a high interest rate for your credit card from a big bank and start savings money now. APPLY ONLINE NOW!

Important points about our Online Applications ![]()

The Unilever Federal Credit Union uses DocuSign – a simple yet secure system that allows us to send you documents and get your signature electronically. Just follow the prompts for applying your signature, initials, date, etc. Once you have completed the Online Application, a representative will be contacting you shortly

| How Much Could You Be Saving? |

Balance | Other Credit Cards |

UFCU Visa Card |

| Annual Percentage Rate (APR) | 16.24% | 3.25% INTRO APR for 12 Months on balance transfers | |

| Monthly Interest | $10,000 | $135.42 | $27.08 |

| Average SAVINGS over 12 months |

Based on $10,000 | $1300.00 |

For more information, please see our credit card agreement

* The ANNUAL PERCENTAGE RATE (APR) is subject to change monthly on the first day of the billing cycle to reflect any change in the Index. It will be determined by the Prime Rate as listed in the “Money Rates” section of The Wall Street Journal on the first business day of each month to which we add a margin. The APR will never be greater than 18.00%. Any increase in the APR will take the form of additional payments shown as Total Minimum Payments on the statement. If the Index is no longer available, the Credit Union will choose a new index which is based upon comparable information. Your credit limit and initial interest rate will depend on your ability to repay and your credit worthiness. Credit limits over $10,000 require a minimum 760 FICO credit score. ** APR for Balance Transfers Visa Gold 3.25% Introductory APR for a period of 12 billing cycles. After that your APR will be 6.75% to 13.75%, based on your creditworthiness. This APR will vary with the market based on the Prime Rate. ** APR for Balance Transfers Visa Platinum Rewards 3.25% Introductory APR for a period of 12 billing cycles. After that your APR will be 7.75% to 14.75%, based on your creditworthiness. This APR will vary with the market based on the Prime Rate.